Men and women processing farm grains at Morrison Milling, serving meals at Wyatt Cafeterias and doing transportation, retail, healthcare and other types of work across Texas were covered by the first injury benefit programs. Their employers broke new ground in 1989 in an imperative mission to save money and avoid massive employee layoffs. Way back then, it was a matter of business survival, unable to pay the exorbitant cost of Texas workers’ compensation insurance.

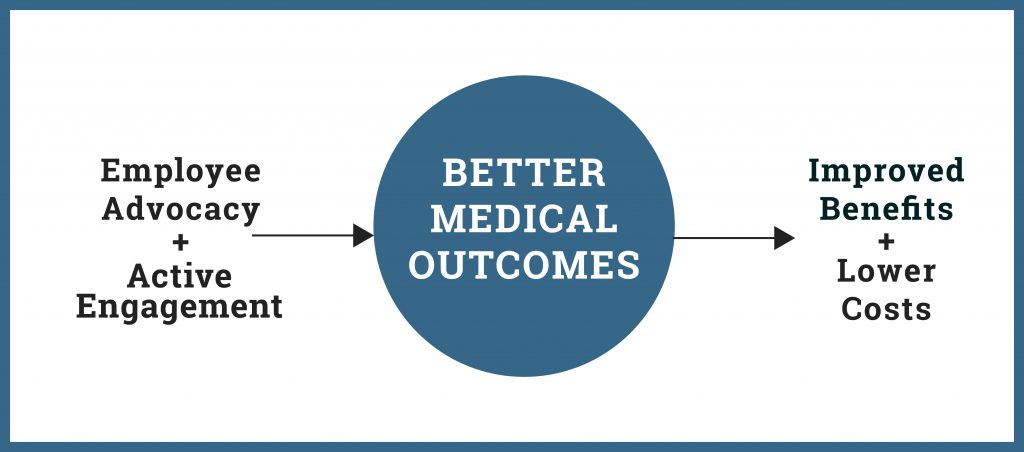

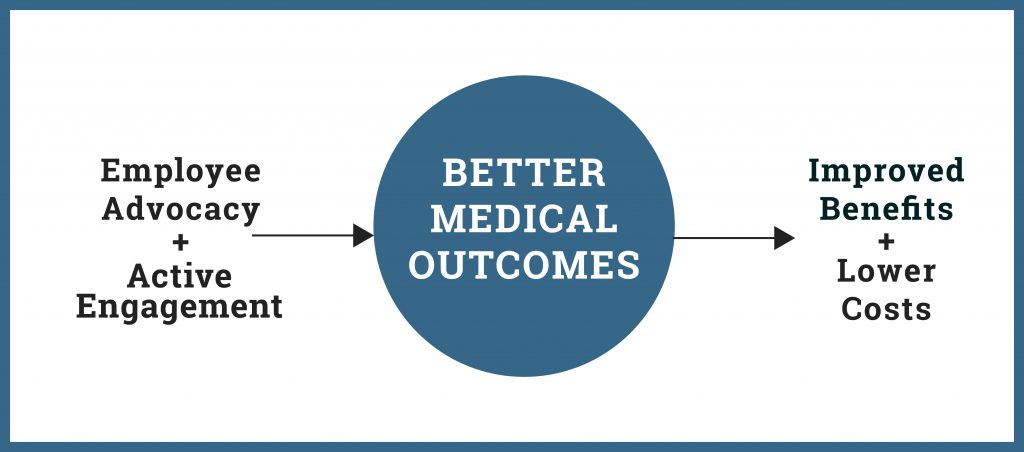

Today, with the advantage of three decades of experience and data, companies better understand that Employee Advocacy and Active Engagement are really the keys to achieve Better Medical Outcomes. Those outcomes, in turn, fund Improved Benefits and Lower Costs.

Validated studies by academics, major insurance companies and actuaries – relying upon statistically credible data and hands-on investigation – have confirmed that such cost savings are immediate, substantial and consistent. For example:

- Stanford University found that employers sponsoring Texas injury benefit programs generate average cost savings that can exceed 50 percent.

- Workers’ compensation industry thought leaders, Peter Rousmaniere and Jack Roberts, also found significant employer cost savings. They noted the stable regulatory framework that has allowed insurers to design insurance products and underwrite with confidence, at lower taxpayer expense.

Benchmarking studies from Aon Risk Solutions and a study reviewed by a former actuary from the National Council on Compensation Insurance also confirm cost savings through better medical outcomes, as well as accelerated claim payouts and claim closure.

Cost competition between workers’ compensation and injury benefit programs has spurred significant Texas workers’ compensation system reforms, with regulators and insurers feeling a greater sense of urgency to effectively implement such reforms. Of particular benefit to small employers, Texas workers’ compensation insurance premium rates have been cut in half over the past decade.

Hundreds of millions of dollars in taxpayer expense has also been saved by moving more than one million injury benefit claims into the more familiar and efficient framework of “ERISA”, which is used for most other employee benefit programs.

We will always be able to find fault with a particular, anecdotal workers’ compensation or injury benefit claim story where poor decisions were made or things otherwise did not turn out well. But we can also see great results by carefully examining recent improvements, credible research on positive medical outcomes (like the studies linked above), and the facts on what is actually happening in the vast majority of claims.

This video puts cost savings into perspective for both injured workers and employers, with money rechanneled back into workplace safety, new jobs and employee compensation:

A singular goal of cost savings may have led those original, pioneering companies to implement the first Texas injury benefit programs 30 years ago. But a more mature focus on long-term sustainability has helped make Texas an economic powerhouse and delivered outstanding results for Texas employers, as well as injured workers and their families.

This concludes our six-part series on how innovative Texas injury benefit programs advance the same goals as workers’ compensation programs.