Nothing could deter Tim from taking care of the needs of his family…until he fell 12 feet from a ladder, could not work for three months, and lost the full use of his right leg. When injuries occur at work across the State of Texas every day, the adequacy of injury benefits coverage is a big deal! Many recent “national conversations”, court cases and meetings of state regulators, judges, lawyers, unions, injured workers, employers, insurance companies and medical professionals have highlighted, but found few solutions to the important need for better injury benefits.

Structural hurdles: Thought leader Peter Rousmaniere’s insightful case studies have demonstrated the severe financial hardship injured workers and their households frequently face – through no fault of their own – when missing days from work. And the issue of benefit adequacy goes beyond wage replacement. For example, in analyzing compensation for an injured worker’s permanent bodily damage, Rousmaniere notes how, “Disability award systems are mired in politics and inertia.” Specifically, we must face:

- “our flawed over-reliance on impairment ratings”, with 21 states depending upon editions of the American Medical Association impairment guidelines published as far back at 1988, and fierce legal challenges in states that have adopted the current edition of AMA guidelines,

- “…an artifice of formulaic thinking, not direct observation of the whole person,

- “…crude predictors of future job earnings,

- “…a blunt tool to predict one’s future experience in the labor market,

- that “…assumes stupendous guesswork”,

- “… may not make street sense” and is

- “…becoming even worse.”

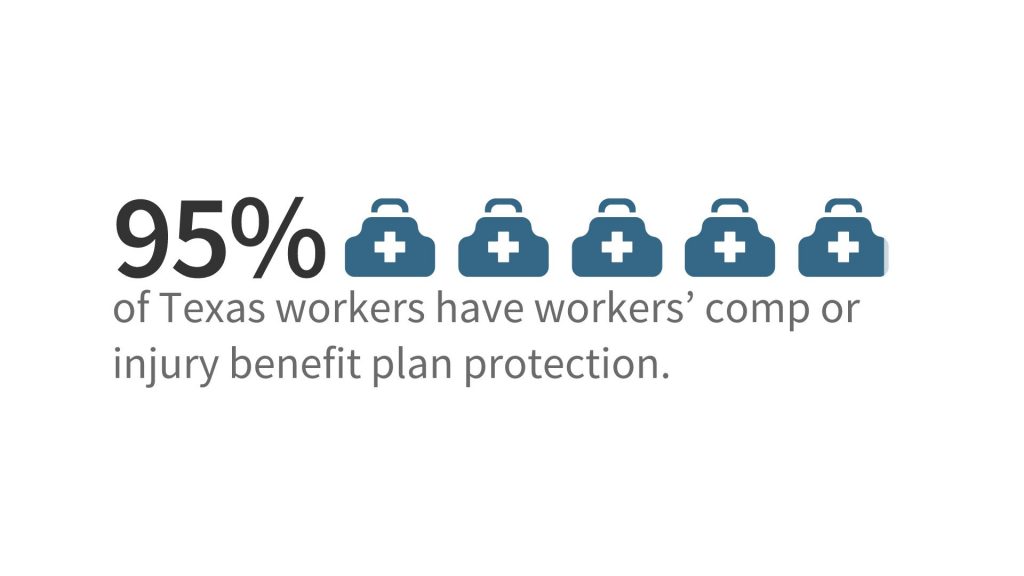

Every worker deserves coverage: In an effort to deflect attention from these workers’ comp system issues, some have proclaimed that “Opt Out” from Texas workers’ compensation is even worse! However, let’s be clear: The term “Opt Out” – today – refers to employers doing nothing (or very little) for their injured workers. The Association for Responsible Alternatives to Workers’ Compensation (ARAWC or “A-Rock”) rejects that approach and is actively advocating for all Texas workers to be covered by either workers’ compensation or a responsible injury benefit program.

Basic expectations: A responsible Texas injury benefit program must pay 100% of all reasonable and necessary medical expenses, as well as wage replacement, death and dismemberment benefits. Such a plan must provide these benefits for work-related accidents, occupational diseases, and cumulative trauma, comply with state and federal laws that ensure transparency, provide a full and fair review of all injury benefit claims, and be backed by “A” rated insurance coverage. Responsible injury benefits must also be paid on a “no-fault” basis, without regard to whether the injury was caused by the employer, the worker, or a third party.

How wage replacement can work: Most Texas workers participating in injury benefit programs receive higher wage replacement benefits that are paid on the employer’s normal payroll system (including direct deposit). That means no payday is missed and normal payroll deductions apply for any savings and retirement plan, group health insurance, child support garnishments, and union dues. Such plans encourage active communication between employers and injured workers, so they don’t sit at home, feeling abandoned or dropped into a complex regulatory machine.

Benefits plus recoveries for negligence liability: Perhaps most significantly, employers electing to setup a Texas injury benefit program give up the “exclusive remedy” protection of workers’ compensation. As a result, injured Texas workers have two avenues of recovery: (1) The injury benefit program, as well as (2) settlements and awards for any employer negligence that caused the injury. As discussed in Part 3 of this Innovation Series, negligence liability exposure is real and a powerful force for good, supporting more robust job training and safety programs. Liability exposure also incentivizes payouts to address an injured workers economic and non-economic damages.

Replacing formulas with common sense: Injury benefits can be paid under a group plan and, in certain cases, an individual, supplemental benefit plan. And unlike Texas workers’ compensation, these programs do not solely rely upon charts and formulas interpreted by non-physicians. Negligence liability settlements and awards also rely upon direct observation and feedback from the injured worker and their legal counsel, the advice of medical doctors regarding the employee’s lifetime needs, and common sense. Physicians help the parties fully value all future medical expenses, lost wages, loss of wage earning capacity, and permanent bodily damage, as well as pain and suffering (which is not compensated under Texas workers’ compensation). Such agreements must comply with Texas statutory protections related to post-injury waivers of negligence.

Freedom to improve: Texas injury benefit programs and related claim procedures are being continuously improved to rapidly address changes in the workforce, law, public policy, medicine and technology. Such updates don’t require years of legislative and regulatory hand-wringing to implement.

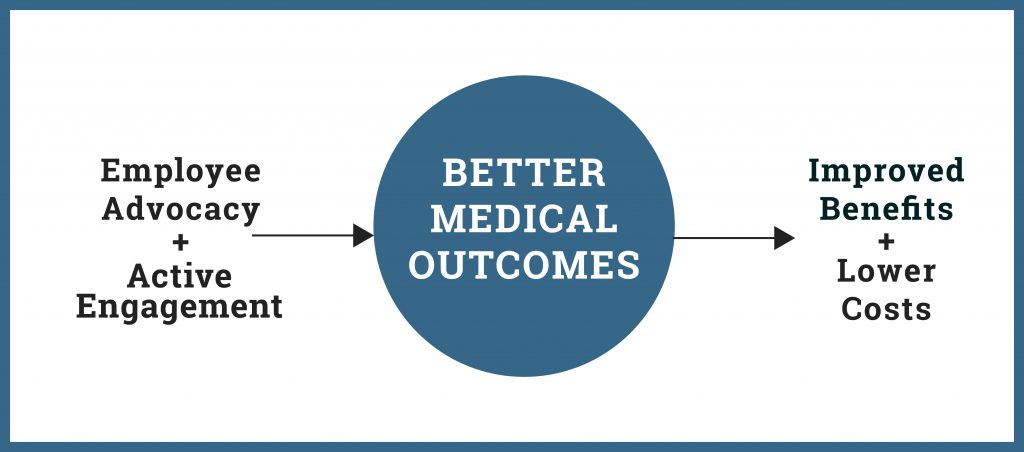

Cost shifting? We also carefully evaluate and make good faith efforts to address stakeholder concerns. Sometimes, this has led to program-level changes, like the injury reporting criteria and other improvements discussed in one of my recent blogs. But sometimes, concerns that are expressed simply reflect the need for more research and dialogue. For example, concerns that Texas injury benefit programs shift costs to taxpayers and other government programs fail to consider:

- These recent injury benefit program improvements,

- Better medical outcomes, with faster, sustained return to work, and

- Payment of higher wage replacement benefits.

Succeeding day-in and day-out: On any given day, thousands of injury benefit payments are being professionally processed, and dozens of negligence liability claims are being litigated – and successfully resolved – for injured workers and employers across the State of Texas.

Tim’s family still has bills to pay while he’s home recovering from his fall from a ladder. And Tim may have needs that go well-beyond what any formulaic compensation system can fully address. Take a look at this video to see two more real stories of how the combination of voluntary benefit plan payments, negligence liability exposures and common sense are helping Texas employers “go above and beyond” in addressing the needs of injured workers and their families: