Table of Contents

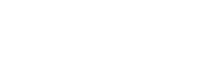

Workers’ compensation and Texas injury benefit programs pursue these same five goals:

Benefits & Negligence Liability in Balance

Negligence Liability. With no workers’ compensation insurance coverage, Texas employers are fully exposed to negligence liability claims for an injured workers actual and punitive damages. The Texas Labor Code strips these employers of defenses based on an injured worker’s assumption of risk or contributory (or comparative) negligence, or the negligence of a fellow employee. This liability exposure is a powerful force in motivating employer investments in job training, safety programs and injury benefits coverage. Such lawsuits have developed a deep body of case law and an experienced group of attorneys representing employers and injured workers. These benefit and liability exposures are fully insurable within a competitive insurance market (subject to a deductible or self-insured retention that requires the employer to always have dollars at risk).

Read more at:

ERISA Basics

Every separate state workers’ compensation system relies on its own unique statutes, administrative rules and bureaucracy. Texas injury benefit programs rely upon the same federal laws and related government oversight that has worked well for over 40 years with other forms of employer-sponsored benefit programs (like group health plans, disability programs and 401(k) plans).

Congress enacted the Employee Retirement Income Security Act of 1974 (“ERISA”) to protect “the interests of participants in employee benefit plans and their beneficiaries, by requiring the disclosure and reporting to participants and beneficiaries of financial and other information with respect thereto, by establishing standards of conduct, responsibility, and obligation for fiduciaries of employee benefit plans, and by providing for appropriate remedies, sanctions, and ready access to the Federal courts.” These laws have supported the efficient processing of Texas injury benefit claims for three decades.

In brief, ERISA requires:

- Clear Communication and Disclosure of Employee Rights and Responsibilities – through an official Plan document, a Summary Plan Description provided to every covered employee (understandable by the average employee regarding benefits provided, any exclusions and limitations, and how benefits can be obtained, including interpretive assistance, and periodic updates), and any Summary of Material Modifications. Plan fiduciaries must provide these and all benefit claim documents within strict timeframes or face stiff penalties.

- Employer Accountability and Fiduciary Responsibility – ERISA provides a robust system of employee protections that includes fiduciary rules, very detailed claim procedures that ensure a full and fair review of benefit claims (including discovery, separate levels of review and access to the courts), and other administrative safeguards.

- State & Federal Law Hybrids are the Norm. The application of state labor and insurance laws, as well as federal labor and employee benefit laws, to employer-sponsored benefit plans has been the norm in Texas and other states for many decades. For example, just like Texas injury benefit programs, workers’ compensation programs must comply with federal laws like the Family and Medical Leave Act (FMLA), Americans With Disabilities Act (ADA), Occupational Safety and Health Act (OSHA), and Fair Labor Standards Act (FLSA).

- Acceptance by the Insurance Community. Insurance markets and insurance agents are very familiar with and have relied upon ERISA as a fair system of administration for employer-sponsored group health, disability and retirement plans for over 40 years. They have existing personnel and resources to support ERISA compliance, as well as proven, free-market insurance underwriting models.

Read more about public policies supported by ARAWC in this “19 Points of Agreement” blog post.

Recent Improvements

Read our list of Top 5 Texas Injury Benefit Plan Improvements 2016-2019 here.